Are you a teacher looking to save money on tax preparation? Look no further than TurboTax coupons! As tax season approaches, it’s important to find ways to save on the costs of filing your taxes. TurboTax offers a variety of discounts and coupons that can help teachers get the most out of their tax return. In this article, we’ll explore who qualifies for TurboTax discounts, where to find coupons, and other ways teachers can save on tax preparation. We’ll also provide a step-by-step guide to using TurboTax coupons and highlight the benefits of using TurboTax for teachers. So, let’s get started and make tax season a little less stressful!

Contents

- Who Qualifies for TurboTax Discounts?

- Where to Find TurboTax Coupons for Teachers

- Other Ways Teachers Can Save on Tax Preparation

- Expert Tax Advice for Teachers

- How to Redeem TurboTax Coupons for Teachers

- Benefits of Using TurboTax for Teachers

- Conclusion

-

Frequently Asked Questions

- Can teachers get discounts on TurboTax products?

- What tax deductions and credits are available for teachers?

- How can teachers find TurboTax coupons?

- What is the benefit of using TurboTax for teachers?

- What features does TurboTax offer for teachers?

- What is the cost comparison of TurboTax vs. other tax preparation services for teachers?

- How do I redeem TurboTax coupons?

- What should I do if my TurboTax coupon code doesn’t work?

- Can TurboTax help me with my state taxes as well?

- What if I need help with my taxes while using TurboTax?

- References

Who Qualifies for TurboTax Discounts?

TurboTax offers discounts to a variety of customers, including students, military personnel, and senior citizens. However, at this time, TurboTax does not offer discounts specifically for teachers. That being said, teachers can still save money on their tax preparation by checking with places they frequently use, such as their bank, credit union, or insurance company, to see if they are TurboTax affiliates. Additionally, TurboTax offers a variety of discount codes that can help all customers save money on their tax preparation. With codes such as “TURBOTAX10” or “TURBOTAX15,” customers can get 10-15% off their TurboTax purchase. It’s important to note that not all discounts can be combined with other offers, so be sure to read the terms and conditions before using any discount codes to ensure you are getting the best deal possible.

Where to Find TurboTax Coupons for Teachers

TurboTax offers special discounts for teachers during tax season. If you’re a teacher looking to save on tax preparation, here are some ways to find TurboTax coupons:

- Check the TurboTax website: TurboTax often offers exclusive discounts to teachers on their website. Be sure to check their website frequently for updates and promotions.

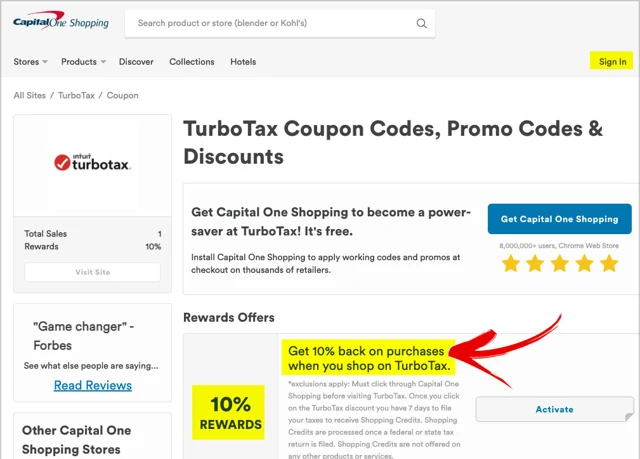

- Look for TurboTax coupon codes: You can find TurboTax coupon codes on various coupon websites such as Coupons.com, RetailMeNot, and Groupon. Simply search for “TurboTax coupon codes” and browse through the available offers.

- Check with your employer: Some employers partner with TurboTax to offer special discounts to their employees, including teachers. Check with your employer’s HR department to see if they offer any TurboTax discounts.

- Visit TurboTax social media pages: Follow TurboTax on social media platforms such as Facebook and Twitter to receive updates on special discounts and promotional offers.

- Sign up for TurboTax emails: Sign up for TurboTax emails to receive exclusive discounts and promotional offers directly to your inbox.

- Check with your bank or credit union: Some banks and credit unions offer special discounts or promotions for TurboTax. Check with your bank or credit union to see if they are TurboTax affiliates.

By using these methods, you can find exclusive TurboTax coupons and discounts for teachers and save money on your tax preparation.

Other Ways Teachers Can Save on Tax Preparation

Aside from using TurboTax coupons for teachers, there are other ways educators can save on tax preparation. One way is to keep track of all work-related expenses throughout the year and claim deductions for these expenses on their tax returns. For instance, teachers can deduct the cost of classroom supplies, such as books, paper, and pencils, as long as they were purchased using their own money.

Another strategy is to enroll in a tax-free savings plan, such as a 403(b) or 457 plan, which is available to teachers and other public employees. These plans allow educators to set aside pre-tax income for retirement, which can reduce their taxable income and lower their tax bill.

Teachers may also qualify for other tax credits, such as the Lifetime Learning Credit, which provides up to $2,000 per year for tuition and other education-related expenses. Additionally, some states offer tax breaks for educators, such as a deduction for classroom expenses or a credit for teacher certification fees.

It’s important for teachers to keep accurate records and consult with a tax professional to ensure they are taking advantage of all available deductions and credits. By doing so, educators can reduce their tax burden and keep more money in their pockets.

Expert Tax Advice for Teachers

As a teacher, it’s important to take advantage of all the tax deductions and credits available to you. However, navigating the tax code can be confusing and overwhelming. That’s where expert tax advice comes in.

Some tax preparation services, like TurboTax, offer access to tax experts who can answer your questions and provide personalized advice. These experts are trained to understand the nuances of the tax code and can help you identify deductions and credits you may have missed.

In addition to speaking with a tax expert, there are other resources available to teachers looking for tax advice. The IRS website offers a variety of publications and resources specifically for educators. These resources cover topics such as deductions for classroom supplies and reimbursements for professional development expenses.

Another option is to consult with a tax professional. A certified public accountant (CPA) or enrolled agent (EA) can provide in-depth tax advice tailored to your specific situation. While this option may be more expensive than using a tax preparation service, it can be worth it if you have complex tax issues or a high income.

Tax Advice Resources for Teachers:

- TurboTax Experts

- IRS Website for Educators

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

Regardless of which option you choose, it’s important to seek out tax advice from qualified professionals. By taking advantage of all the deductions and credits available to you, you can save money on your taxes and keep more of your hard-earned income.

How to Redeem TurboTax Coupons for Teachers

Step-by-Step Guide to Using TurboTax Coupons

Using TurboTax coupons for teachers is an easy process that can save you money on your tax preparation. Here is a step-by-step guide to help you redeem your coupons:

1. Visit the TurboTax website and select the product that you want to purchase. Make sure to select the product that corresponds to your coupon.

2. Create an account or sign in to your existing account.

3. Enter the coupon code in the appropriate field during checkout. Make sure to double-check the code to ensure that it is correct.

4. Once the coupon code has been verified, you will see the discounted price reflected in your cart.

5. Complete your purchase and begin using TurboTax to prepare your taxes.

Common Issues with TurboTax Coupons and How to Fix Them

While using TurboTax coupons for teachers is a straightforward process, there are some common issues that you may encounter. Here are some tips for fixing them:

1. Coupon code is not working: This could be due to a number of reasons, such as an expired coupon or a code that is not applicable to the product you are purchasing. Double-check the terms and conditions of the coupon to ensure that you are using it correctly.

2. Discount is not being applied: If the coupon code is being accepted but the discount is not being applied, try clearing your browser’s cache and cookies before trying again.

3. Coupon code cannot be combined with other discounts: Some coupons may not be combined with other discounts or promotions. Make sure to read the terms and conditions of the coupon before attempting to use it.

Using TurboTax coupons for teachers is a great way to save money on your tax preparation. Just follow these simple steps to redeem your coupon and start using TurboTax today!

Step-by-Step Guide to Using TurboTax Coupons

Step 1: First, visit the TurboTax website and select the product that best fits your needs. Keep in mind that there are different versions of TurboTax for different tax filing situations, so make sure to choose the one that is right for you.

Step 2: Once you have selected the right product, you will be prompted to create an account or sign in to an existing account. Follow the on-screen instructions to complete this step.

Step 3: After you have signed in or created an account, you will be taken to the payment page. Look for the option to enter a discount code or coupon code. Enter your TurboTax coupon code and click “apply” to see your savings.

Step 4: Review your order summary to make sure that your coupon code has been applied correctly and that you are getting the right discount.

Step 5: Complete your purchase and start using TurboTax to prepare your taxes. Remember that TurboTax offers expert guidance and support throughout the tax preparation process, so don’t hesitate to reach out if you have any questions or concerns.

Tips: Be sure to check the expiration date of your coupon code before using it, as some codes may have limited time offers. Also, make sure that you are entering the coupon code correctly, as some codes are case-sensitive. If you encounter any issues with your coupon code, contact TurboTax customer support for assistance.

Common Issues with TurboTax Coupons and How to Fix Them

Using TurboTax coupons can be a great way to save money on tax preparation, but sometimes users may encounter common issues while redeeming the coupons. Here are some of the most common issues and how to fix them:

| Issue | Solution |

|---|---|

| The coupon code is not working | Double-check that you have entered the code correctly, including any capital letters or special characters. Ensure that the coupon has not expired and that it is valid for the product you are purchasing. |

| The discount is not being applied | Make sure that you have followed all the necessary steps to redeem the coupon. Some coupons may require you to click on a specific link or enter the code at a certain point in the checkout process. Check the terms and conditions of the coupon to ensure that you are eligible for the discount. |

| The coupon cannot be combined with other offers | Read the terms and conditions of the coupon carefully to ensure that it can be combined with other offers. Some coupons may not be used in conjunction with other discounts or promotions. |

| The coupon has already been used | Most coupons can only be used once per customer. If you have already used the coupon, it will not work again. Look for other coupons or discounts to use instead. |

If you encounter any other issues while using TurboTax coupons, contact customer support for assistance. They can help you troubleshoot the issue and ensure that you get the discount you are entitled to.

Benefits of Using TurboTax for Teachers

1. Maximum Deductions and Credits: TurboTax for Teachers helps educators to identify all the tax deductions and credits they are eligible for. Teachers can claim certain deductions on their income taxes that aren’t available to people in other professions. With TurboTax, teachers can easily navigate through the tax preparation process and ensure they get the maximum refund.

2. User-Friendly Interface: TurboTax has a user-friendly interface that helps teachers to file their taxes with ease. The software guides them through each step of the tax preparation process, making it simple and stress-free.

3. Expert Tax Advice: TurboTax offers expert tax advice that is specifically tailored to educators. Teachers can ask questions and receive answers from tax experts who have experience in dealing with education-related tax issues.

4. Affordable Pricing: TurboTax offers affordable pricing options for teachers. They can choose from a variety of plans that suit their needs and budget. With TurboTax, teachers can save money on their tax preparation fees.

5. Mobile Access: TurboTax for Teachers is available on mobile devices, making it easy for educators to file their taxes anytime, anywhere. They can access the software on their smartphones or tablets and complete their tax returns on the go.

6. Accuracy Guarantee: TurboTax offers an accuracy guarantee, ensuring that teachers’ tax returns will be accurate. If there are any errors, TurboTax will pay for any penalties or interest that may result from those errors.

7. Safe and Secure: TurboTax uses the latest security measures to protect teachers’ personal and financial information. Teachers can file their taxes with confidence, knowing that their information is safe and secure.

TurboTax for Teachers offers many benefits that make tax preparation easy, stress-free, and affordable. With its user-friendly interface, expert tax advice, and affordable pricing, teachers can file their taxes with confidence and get the maximum refund they deserve.

Why Teachers Should Use TurboTax for Tax Preparation

TurboTax is an excellent choice for teachers who want to simplify the tax preparation process. Here are some reasons why teachers should use TurboTax for their tax preparation needs:

- User-friendly interface: TurboTax has a user-friendly interface that makes tax preparation easy, even for those who are not experienced in tax preparation.

- Expert guidance: TurboTax offers expert guidance to help teachers maximize their deductions and credits, ensuring that they get the biggest refund possible.

- Convenience: TurboTax offers the convenience of online tax preparation, which means that teachers can prepare their taxes from the comfort of their own homes.

- Accuracy: TurboTax uses the latest tax laws and regulations to ensure that teachers’ tax returns are accurate.

In addition to these benefits, TurboTax also offers features that are specifically designed for teachers. For example, TurboTax offers a teacher tax deduction finder, which helps teachers identify tax deductions that they may qualify for. TurboTax also offers a guide to educator tax deductions and credits, which provides teachers with detailed information on the tax deductions and credits that are available to them.

Compared to other tax preparation services, TurboTax is also more affordable. According to a recent cost comparison, TurboTax is significantly less expensive than other tax preparation services, such as H&R Block and Jackson Hewitt.

TurboTax is an excellent choice for teachers who want to simplify the tax preparation process and maximize their tax savings. With its user-friendly interface, expert guidance, and affordable pricing, TurboTax is the perfect solution for teachers who want to save time and money on their tax preparation.

Features of TurboTax for Teachers

TurboTax offers a range of features designed specifically for teachers to make tax preparation easy and stress-free. Some of the key features include:

| Education Credits | TurboTax helps teachers maximize their education-related tax credits, including the American Opportunity Credit, Lifetime Learning Credit, and Teacher Expense Deduction. |

| Charitable Donations | Teachers can easily track and deduct charitable donations made to schools and other educational organizations. |

| State Tax Filing | TurboTax allows teachers to easily file both federal and state taxes. |

| Deduction Finder | TurboTax’s Deduction Finder tool helps teachers identify all the deductions they may be eligible for, including those related to classroom supplies, professional development, and travel expenses. |

| Expert Help | TurboTax offers access to expert tax advice and support throughout the tax preparation process. |

These features, combined with TurboTax’s user-friendly interface and affordable pricing, make it the ideal tax preparation solution for teachers. With TurboTax, teachers can easily and accurately file their taxes and get the biggest refund possible.

Cost Comparison: TurboTax vs. Other Tax Preparation Services

When it comes to tax preparation services, there are many options available to teachers. However, TurboTax stands out as one of the most affordable and user-friendly options on the market. Compared to other tax preparation services, TurboTax offers a number of features that make it the best choice for teachers who want to maximize their deductions and credits while minimizing their costs.

One of the biggest advantages of TurboTax is its low cost. Unlike other tax preparation services that charge exorbitant fees for their services, TurboTax offers a range of affordable options that are tailored to the needs of teachers. Whether you’re a freelancer, small business owner, or simply looking to file your personal taxes, TurboTax has a plan that will fit your budget.

In addition to its low cost, TurboTax also offers a number of features that make it the best choice for teachers. For example, TurboTax offers a user-friendly interface that makes it easy to navigate even for those who are new to tax preparation. It also offers expert guidance and support to help you maximize your deductions and credits, ensuring that you get the biggest refund possible.

When compared to other tax preparation services, TurboTax is the clear winner in terms of cost and features. Not only is it more affordable than many of its competitors, but it also offers a range of features that are tailored to the needs of teachers. So if you’re looking for a reliable and affordable tax preparation service, look no further than TurboTax.

Conclusion

In conclusion, TurboTax is a reliable and efficient tax preparation service that can greatly benefit teachers. With its user-friendly platform and expert tax advice, TurboTax can help save time and money during tax season. While TurboTax does not currently offer discounts specifically for teachers, there are other ways for teachers to save on tax preparation, such as finding TurboTax coupons through affiliates or taking advantage of other available discounts. Additionally, TurboTax’s cost is competitive compared to other tax preparation services, making it a great choice for teachers on a budget. Overall, TurboTax is a valuable tool for teachers looking to simplify the tax preparation process and maximize their savings. So, if you’re a teacher looking for a reliable and cost-effective way to file your taxes, consider using TurboTax.

Frequently Asked Questions

Can teachers get discounts on TurboTax products?

TurboTax does not offer discounts to teachers at this time. However, you can check with places you frequently use, such as your bank, credit union, or insurance company, to see if they are TurboTax affiliates.

What tax deductions and credits are available for teachers?

Teachers can claim certain deductions on their income taxes that aren’t available to people in other professions. Some of these tax tips include deducting classroom supplies, continuing education expenses, and travel expenses.

How can teachers find TurboTax coupons?

Teachers can find TurboTax coupons by checking coupon websites, subscribing to TurboTax’s email list, or following TurboTax on social media. You can also check with your employer or professional organizations to see if they offer any TurboTax discounts.

What is the benefit of using TurboTax for teachers?

TurboTax is a user-friendly tax preparation software that can help teachers maximize their tax deductions and credits. It also offers expert tax advice and cost-effective pricing options.

What features does TurboTax offer for teachers?

TurboTax offers a variety of features for teachers, including a simplified tax preparation process, step-by-step guidance, automatic import of W-2 and 1099 forms, and access to a tax expert for any questions or concerns.

What is the cost comparison of TurboTax vs. other tax preparation services for teachers?

TurboTax offers competitive pricing options for teachers, with prices ranging from free for simple tax returns to more expensive packages for more complex tax situations. However, it’s important to compare pricing options with other tax preparation services to find the best deal for your needs.

How do I redeem TurboTax coupons?

To redeem TurboTax coupons, simply enter the coupon code during the checkout process. Make sure to double-check the expiration date and any restrictions or limitations on the coupon before using it.

What should I do if my TurboTax coupon code doesn’t work?

If your TurboTax coupon code doesn’t work, first make sure that you have entered the code correctly and that it hasn’t expired. If you are still having issues, reach out to TurboTax customer support for assistance.

Can TurboTax help me with my state taxes as well?

Yes, TurboTax can help you with your state taxes as well as your federal taxes. Simply select your state when prompted during the tax preparation process.

What if I need help with my taxes while using TurboTax?

TurboTax offers a variety of resources for tax assistance, including access to a tax expert for any questions or concerns, a community forum for peer support, and a searchable database of tax FAQs.